Sizeable and diversified production base.

We are the largest independent E&P company in Angola by production and one of the largest in Sub-Saharan Africa by production.

Azule Energy’s investor proposition

- Sizable portfolio of producing offshore assets

- Reserves base diversified over several producing blocks

- Well integrated series of near, mid and long-term growth opportunities

- We leverage our Shareholders’ expertise in exploration, fast-track project execution and operations

- Conservative leverage and significant cash flow generation

- Clear ESG policies and commitment to support Angola in its energy transition journey

Adriano Mongini, CEO

“Our mission is to responsibly meet Angola and the world’s growing energy needs while driving a sustainable future. We aim to safely deliver long-term value to our shareholders, employees, and communities. Our strategy is centered on three core pillars: operational excellence and safety, value creation, sustainability and environmental stewardship. We are committed to maximizing efficiency, investing in advanced technologies, and expanding our portfolio.”

Adriano Mongini, CEO

“Our mission is to responsibly meet Angola and the world’s growing energy needs while driving a sustainable future. We aim to safely deliver long-term value to our shareholders, employees, and communities. Our strategy is centered on three core pillars: operational excellence and safety, value creation, sustainability and environmental stewardship. We are committed to maximizing efficiency, investing in advanced technologies, and expanding our portfolio.”

Michael Fidler, CFO

“Our financial strategy is focused on delivering sustainable growth, maintaining strong financial discipline, and supporting our group’s energy portfolio. We are committed to maximizing value for our shareholders through efficient capital allocation, cost-effective operations, and value accretive investments. By managing our resources prudently and efficiently, we aim to support our business while ensuring long-term financial strength and stability.”

Michael Fidler, CFO

“Our financial strategy is focused on delivering sustainable growth, maintaining strong financial discipline, and supporting our group’s energy portfolio. We are committed to maximizing value for our shareholders through efficient capital allocation, cost-effective operations, and value accretive investments. By managing our resources prudently and efficiently, we aim to support our business while ensuring long-term financial strength and stability.”

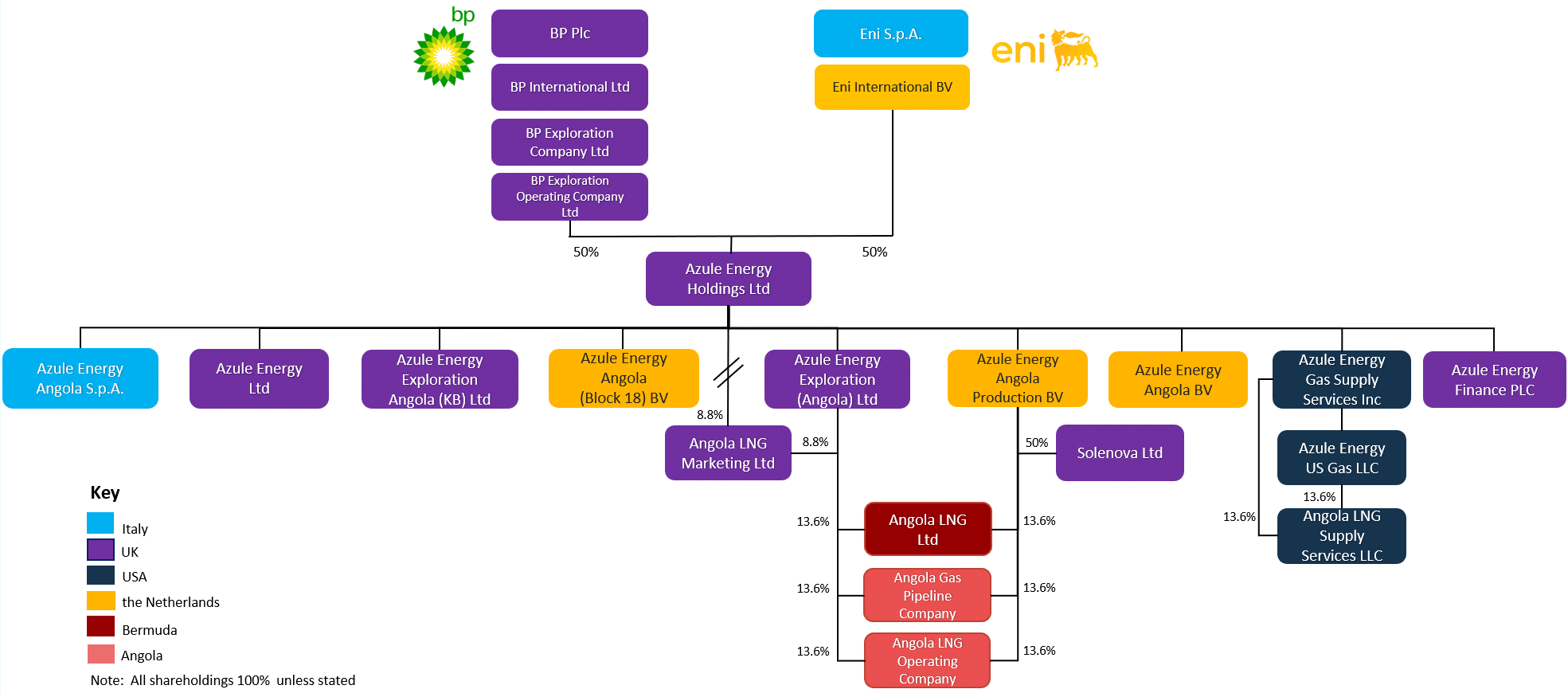

Group structure

Azule Energy Holdings Limited (AEHL) is the company that primarily manages Group Treasury, Group Tax, Company Secretary, Group Reporting and Internal Audit activities.

Azule Energy’s leadership team, including the CEO and CFO, is appointed by AEHL’s subsidiaries for managing their operation through their respective registered branches in Angola.

Financial Statements

Explore our financial statements by clicking in the links below:

Annual Report and Financial Statements for the Year Ended 31 December 2022

____

Annual Report and Financial Statements for the Year Ended 31 December 2023

____

Interim Condensed Consolidated Financial Statements for the nine months ended 30 September 2024

Corporate credit ratings

Bond and instrument credit ratings

Rule 144A Global Note: US05501YAA64

Governance Highlights

bp and Eni have deployed senior executives to Azule Energy given the strategic importance for both Shareholders’ Africa operations.

There is strong oversight by the Shareholders through Board of Directors and Board committees which include representatives of both bp and Eni.

Board of Directors comprised of senior appointees from bp and Eni

ESG Highlights

With a vision of sustainability, innovation, and growth and by investing in the oil and gas sector in combination with decarbonisation technologies and renewable energy supply, the Group aims to create a more resilient and reliable energy system for Angola and the wider region.

- Target reduction in absolute GHG emissions by 40% vs 2019 levels by 2030.

- Target reduction of total flaring by up to 75% by 2030 vs 2019 levels and eliminate all routine flaring.

- Target near-zero methane emissions by 2030.

- Aim for ISO 140001 and ISO 50001 certifications.

- Member of OGMP 2.0 and OGDC signatory. Received the Gold Standard Pathway for the 2024 reporting year. Targeting Gold Standard by 2028.

- Plans to double the capacity from current 25MW to 50MW in the Caraculo photovoltaic plant (50-50 JV with Sonangol).

- MoU signed with Sonangol to drive decarbonization initiatives.

- Exploring potential carbon offsetting through Natural Climate Solutions projects.

- Protecting Marine Ecosystems through the support of Mundo Azul and Kitabanga initiatives.

Sustainability Report

Safety

The safety of our employees, contractors and local stakeholders is a fundamental value.

Grounded in bp and Eni’s legacy safety culture, staying safe entails more than the continued adoption of world-class practices and procedures. Azule is committed to nurturing a trusting safety culture within an inclusive and diverse workplace where everyone is treated with respect and dignity.

Environmental

protection

Azule Energy is committed to preserving the environment and to promoting carbon neutrality. Our policy remains consistent with bp and Eni’s environmental values and goals to reach Net Zero 2050.

Azule’s emissions will follow a sustainable trajectory in line with both companies’ environmental targets. Hydrocarbon production and greenhouse gas emissions are reported by the two parent companies on an equity share basis.

Social sustainability

Azule is committed to promote the sustainable development of communities in the country, in line with the Government’s development plans and United Nations Sustainable Development Goals.

We have a portfolio of diverse social initiatives inherited from bp and Eni which target key development areas across access to energy, access to water, health, education and agriculture. Know more about our areas of intervention.

Investor relations contacts

Please use the email below to contact us.

Email: investor@azule-energy.com